3 Tips for Moving with Medicare

We're certainly living in interesting times but what's more interesting is that we're seeing more and more Baby Boomers move to another state than ever before. We want to highlight the three key things to pay attention to when you move.

When you move, you have to switch your plans if you're on Medicare. You have a Special Election Period to switch plans. A Special Election just means that you have a unique situation that opens up a time frame where you can switch plans outside of the traditional October 15th to December 7th Annual Enrollment window.

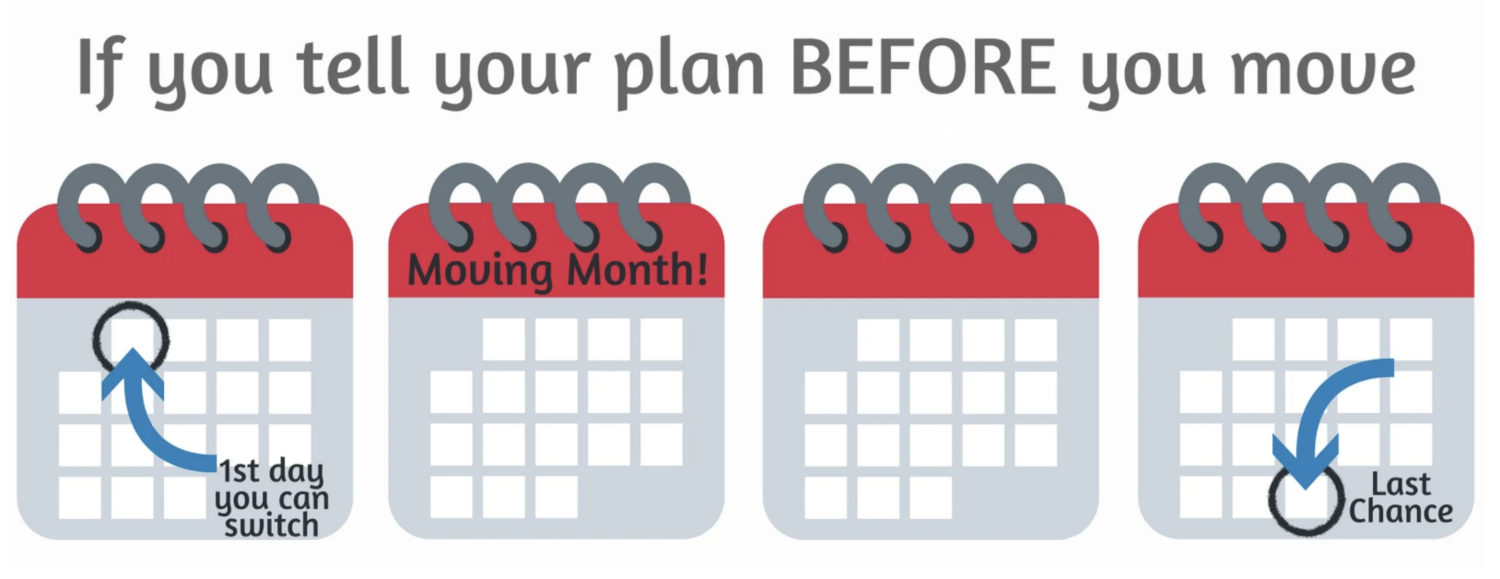

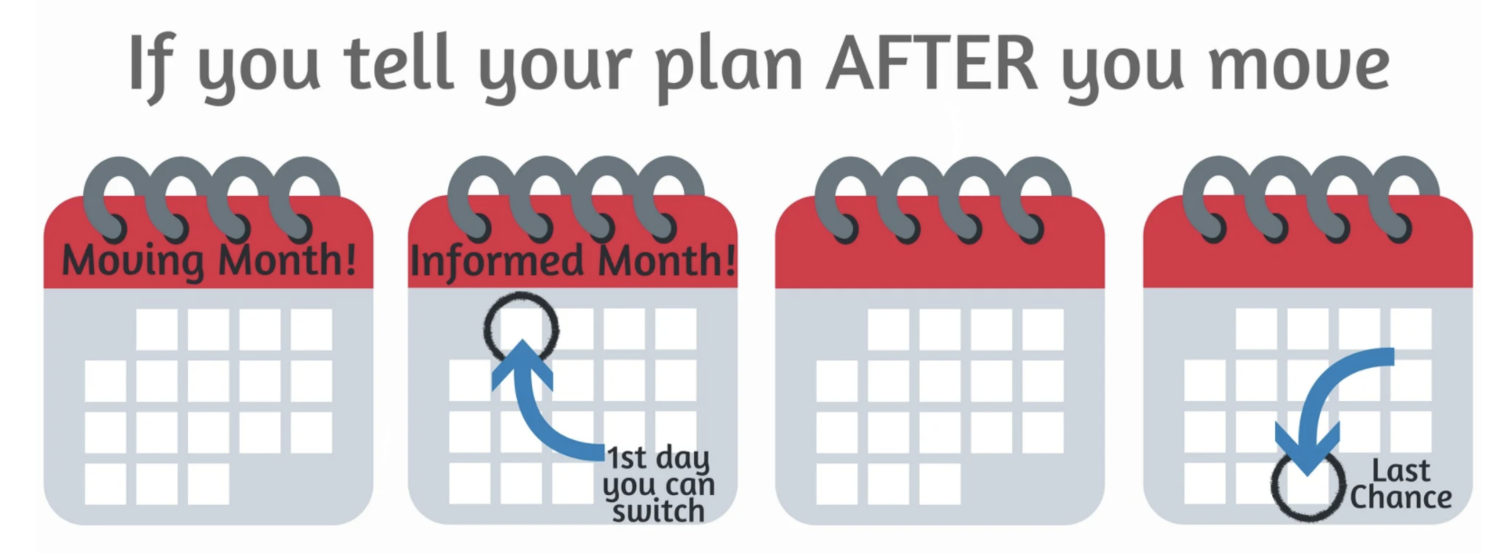

In this particular case, you have a 3 month window the month of and 2 months after your move to sign up for a new prescription or Medicare Advantage plan. The earliest that your new plan can start after your move is the 1st of the month. Recognizing that many of our clients are planners, and would like to get everything set up before the move, unfortunately this has to happen after the move. But you can find flexibility because the technical date of your move depends when you decide to tell your insurance company.

If you end up forgetting or not reporting your move to the insurance company, or because you really like your current plan, it does catch up to you eventually. The insurance company will usually send you a letter stating that you've moved outside of the service area and will usually give you a grace period to sign up for a new plan. They also tell you when they'll drop you from coverage. That date is your deadline to sign up for a new plan. If you do it all in time, you won’t incur any penalties. However, if you decide to ignore the letter or unfortunately it doesn't get to you because of mail or another reason, and all of a sudden you get dropped, you will incur a Part D prescription penalty of roughly 1% per month for each month that you did not have drug coverage. When you sign up for Medicare it is for the rest of your life, so again make sure you just don't get dropped and get new coverage when you're supposed to.

The key here is that you have a Special Election Period to sign up for a new plan. Although there is some flexibility you'll need to be sure to inform your insurance company to avoid penalties.

2. Confirm with your insurance company that your doctors, medications, and extra benefits of whichever new plan you're going into, will stay relatively the same. Even if it's the same plan within the same company.

We are seeing a trend that most people really like their plans and about only 10% of individuals switch each year. During the Annual Enrollment Period again this can be hard to believe with all the ads telling you to switch you think more people would be switching, but in fact, most people are pretty happy with what they've got.

We're also seeing a situation where people will seek out the same insurance company that they used in the past because they’ve had good experiences. We've heard stories where somebody would say, “look my insurance company paid $200,000 towards my medical costs when I was in the hospital because I had a heart disease heart attack or stroke and I'm forever grateful to my company. I will certainly stay with them for as long as they're alive and I'm alive.” If you're looking at the same exact insurance company and even if you're matching up the plan names, it's still important to make sure that the plans are exactly the same. For example, for prescription coverage, a stand alone drug plan, these are the plans where you have a separate card for your medical, your supplement, and then another card for your prescription plan. If you're in that situation and you switch your prescription plan, just remember that even if it's the same company with the same name the prices can still differ from state to state. Most of the time, the drugs that they will cover are usually the same, but make sure to double check. The monthly price and the monthly premium can be different. Your deductibles can be different in your new zip code. That's why if you do have a supplement with a standalone drug plan, you do have to change your drug plan when you move to another state. Make sure that the Co pays and the premiums and its deductibles are still within your accepted budget otherwise be sure to shop around to see if there's any other better bet.

If you have a Medicare Advantage plan (these are the plans where you have one card and includes your medical, your prescription, and usually some extra benefits like a gym membership, dental, vision and so forth), these plans can actually differ from county to county. Which means even if you have a flexible network like a PPO or a HMO that allows you to go out-of-network, moving to another county or another state where that plan is not available means you still have to make a switch. Meaning you have to sign up for a new plan or re-enroll in the same version of that plan in whichever new county or state that you're moving to. Many national companies like a United Health or Aetna or Humana will have similar Medicare Advantage plans across the country. Although there could be some nuanced changes. Co-pays or extra benefits such as your dental or gym and so forth can really vary from state to state even within the same insurance company, so that's why it's really important to double check.

I know I'm sounding like a nagging parent here but we've run into situations where somebody says, “well I just signed up I changed my address and they send me over the new plan but then I realized that my dental wasn't the same or I couldn't go to the same gyms or the same network of gyms” That's why it's really really important to double check before you make a switch.

The other big issue is when you're switching midway through the year. Something that's incredibly frustrating and can catch people by surprise if you're not careful, is that your deductibles and out-of- pocket expenses can be reset during the year. For example let's say you had a drug plan and you had a $400 deductible for brand name medications and you paid it at the beginning of the year when you filled your medications. Now, if you switch to a similar plan during the year because you've moved, that deductible can reset you can be responsible for another deductible midway through the year. For people with high prescription costs this can be pretty hefty. The only exceptions we've seen is when you switch into the same exact plan within the same company and the company decides to say that you're on the same exact plan you haven't switched plans, and they're going to grant you an exception to void that deductible. If you do end up switching to a new drug plan or Medicare Advantage plan, make sure to double check that the deductibles aren't going to reset on you.

3. If you have a Medicare supplemental plan (often F & G most common plans ) you are not actually guaranteed an Election Period. When you move with these types of plans, you can stay in the same plan that you have, because the benefits are going to be the same. You can call your insurance companies to change your address, but it's not going to be an opportunity for you to switch into a new plan. The only thing that you can do is call the insurance company and change your address. If you decide you want another plan, you have to go through the same logistics as if you were just simply switching. Meaning if you have a supplemental plan, and there’s a lower cost supplement plan you want to switch into, in most states you have to go through a medical underwriting process. Assuming you're healthy, you can go into a new plan, whereas, if you're unhealthy, the insurance company will not allow you to do so. Another example of this is if you're moving to a state that doesn't allow medical underwriting, you can switch into the plan there, but for the most part moving doesn't guarantee you a Special Election into a new supplemental plan.

if you have a national company let's say an ARPU or so forth with your supplements, and you change your address, your rates are actually going to change to the new state that you're moving to. For example, here in Rhode Island, rates are reasonably low versus let's say Florida. If you end up moving and changing your address, your rates will be adjusted to the Florida rates versus keeping the rates of the state you moved from. If you end up going with a local insurance company, even though supplemental plans will cover nationally, the rates won't change because your local insurance company won't be able to price for a new state. This is something to watch out for in the planning process, especially if you are thinking about moving in a few years.

4. A bonus tip to cover is foreign travel. Many of our clients move to another country because the dollar goes so much further (granted in this Covid time things are very different) Medically this is something that always comes up: what happens medically if you do need services? Will Medicare cover you overseas? In general, it will not cover you overseas, but a lot of the Supplemental Plans (like an F,G&N) will cover you for $50,000 of overseas travel, but only during the first 60 days of your travel. Meaning if you're staying for the whole year, on day 61 you're on your own. Medicare Advantage plans will typically cover you overseas, but it depends on the coverage level and on the company you choose. Make sure you double check with your insurance company and be aware this is only for emergency care, so you can't get your routine colonoscopy in France as romantic as that may be. If you are going to live overseas for more than 60 days just know that chances are your policy will not cover you, and you’ll probably have to get some type of overseas coverage for medical care just in cases of medical emergencies. We have many clients that will travel back into the US to get care because it will be in-network.

There you have it! Three 3 that are very important to pay attention to if you're going to be moving. We understand this can be overwhelming.

Still confused? Schedule a 30 minute no cost consultation if you're moving and you need to switch plans or if you're just getting on Medicare. Please feel free to reach out and visit our website to book an appointment or call our offices 401-404-7373, 1-800-656-0894 we have a team of advocates that are able to help at no cost to you.

As always Medicare is complex but you don't have to do it alone!