Comparing the 3 most popular Medicare Supplement Plans: F, G and N

Medicare Supplement plans are a great way to help keep your out of pocket costs down and see doctors without needing prior approval or referrals. While these plans aren’t for everyone, they have some great benefits and features. We wanted to use this post to highlight the 3 most common supplement plans we see.

One common mix up we see is Medicare Advantage (Part C) being confused with Medicare Supplement. These are two separate types of Medicare plans, each with their own specific rules and coverages. This blog post details Medicare Supplement plans only. To read more about the differences between Medicare Advantage vs. Medicare Supplement you can read our blog post about “Your One Big Decision” by clicking here.

What is Medicare Supplement? Medicare Supplement plans are plans sold by private insurance companies. A supplement plan acts as secondary coverage to your Original Medicare Part A (Hospital) and Medicare Part B (Outpatient) coverage to cover some or all of the costs Medicare doesn’t cover.

Some of the costs a Supplement plan might cover include:

Part A Deductible - $1484 (2021)

Part B Deductible - $203 (2021)

Part B Co-Insurance - 20%

Supplement plans are also standardized based on letters A-N, ie: (Plan G from Company 1 = Plan G from Company 2) unless you live in MA, WI or MN who each have separate rules for Medicare Supplement plans (we’re going to exclude these states from this post, check back later for a post detailing the specific Supplement rules in these states).

Medicare Supplement plans all have some universal rules they need to follow:

No Networks - Any doctor who accepts Medicare assignment can bill/work with any Medicare Supplement plan. Since there are no networks, referrals are also not required.

Standardized - Again, Supplement plans are standardized. So a Plan G is the same exact plan no matter which insurance company is selling it and which state you’re in. However, the monthly cost can differ drastically.

No Drug Coverage/Extra Benefits - Since 2006, Medicare Supplement plans are not allowed to offer/include drug coverage in the plans. In general, most Supplement plans do not include any extra benefits but some may have gym membership/vision reimbursements or premium discounts.

So, with that in mind let's take a look at the 3 most common Supplement plans; Plan F, Plan G and Plan N.

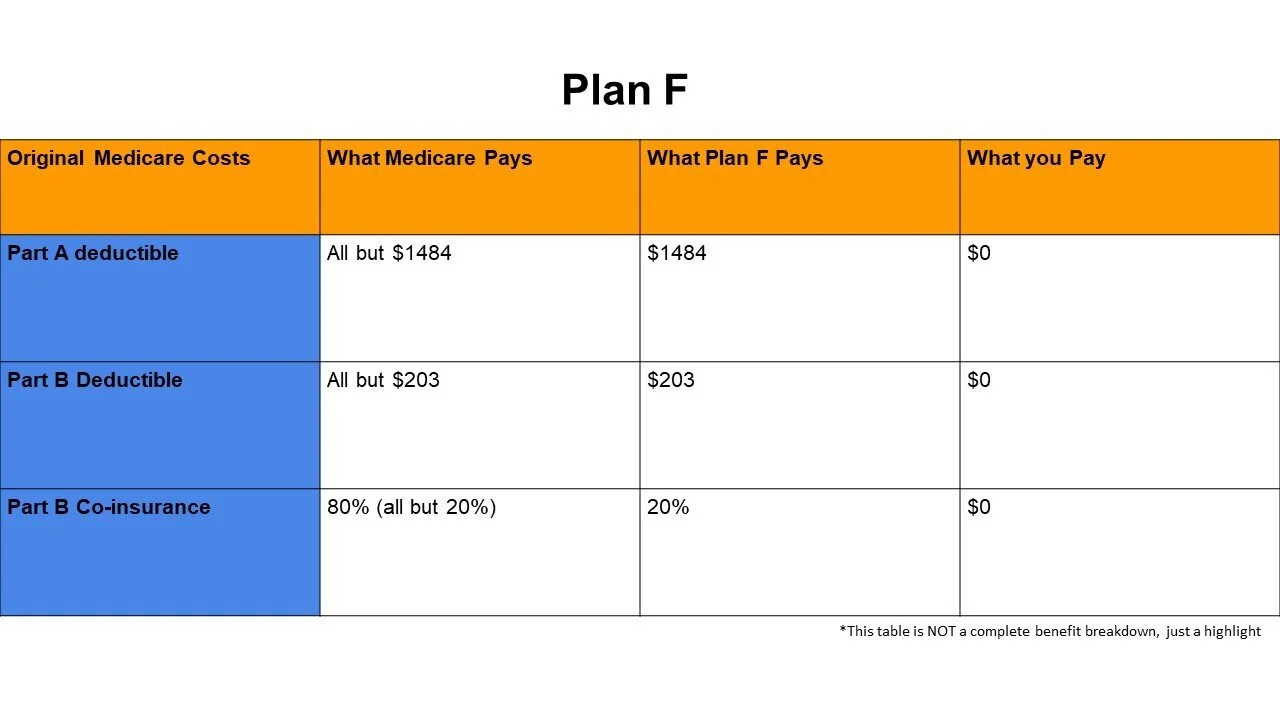

Plan F “The Cadillac” $$$ - We refer to the Plan F as the Cadillac plan. Why? Plan F covers 100% of your out of pocket costs on Original Medicare. These are the Part A and Part B deductibles and coinsurances mentioned above. If the service is covered by Medicare, Plan F should pay 100% of the bill, plain and simple.

There are some tradeoffs for that greater level of coverage. First is that Plan F has a higher monthly cost. The average price for a Plan F, starting at age 65, is around $180+. Due to a recent MACRA ruling if you turned 65 after Jan 1, 2020; you are not eligible to enroll into a Plan F. If you already have a Plan F or turned 65 before Jan 1, 2020 you can still enroll and keep your Plan F. You can read more about that ruling by clicking here.

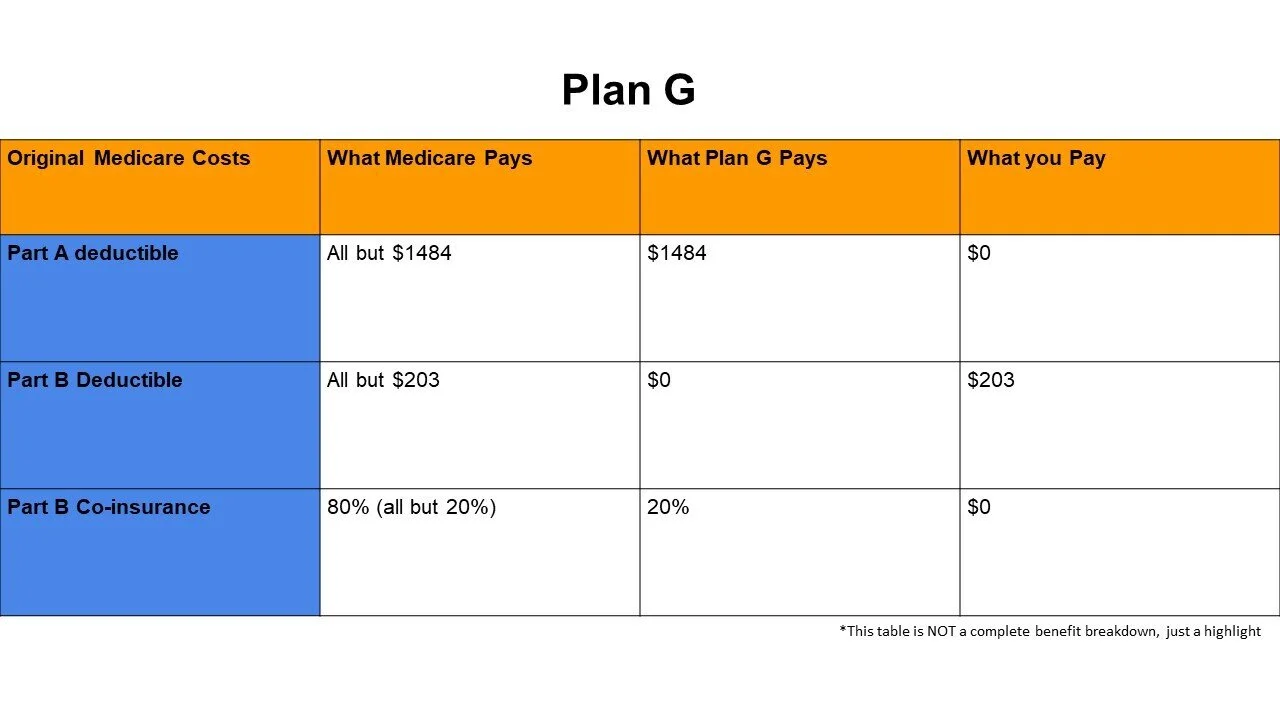

Plan G “The Plan F replacement” $$ - Plan G is another popular Supplement plan. It is very similar to Plan F and has essentially become the Plan F replacement due to the MACRA ruling mentioned above. Plan G will cover 100% of your Part A inpatient costs (up to the Medicare approved amounts). However, you are responsible for the $203 Part B annual deductible, but that’s it. Plan G then comes in to cover the 20% Part B coinsurance.

Since Plan G has a slightly lower benefit for outpatient coverage, the monthly price is lower than a Plan F. Average price for a Plan G at age 65 is about $150/month. In fact, we usually see Plan G over $30 less/month than Plan F. If you do the math, you actually save with a Plan G due to the lower monthly cost, even having to pay $203 out of pocket.

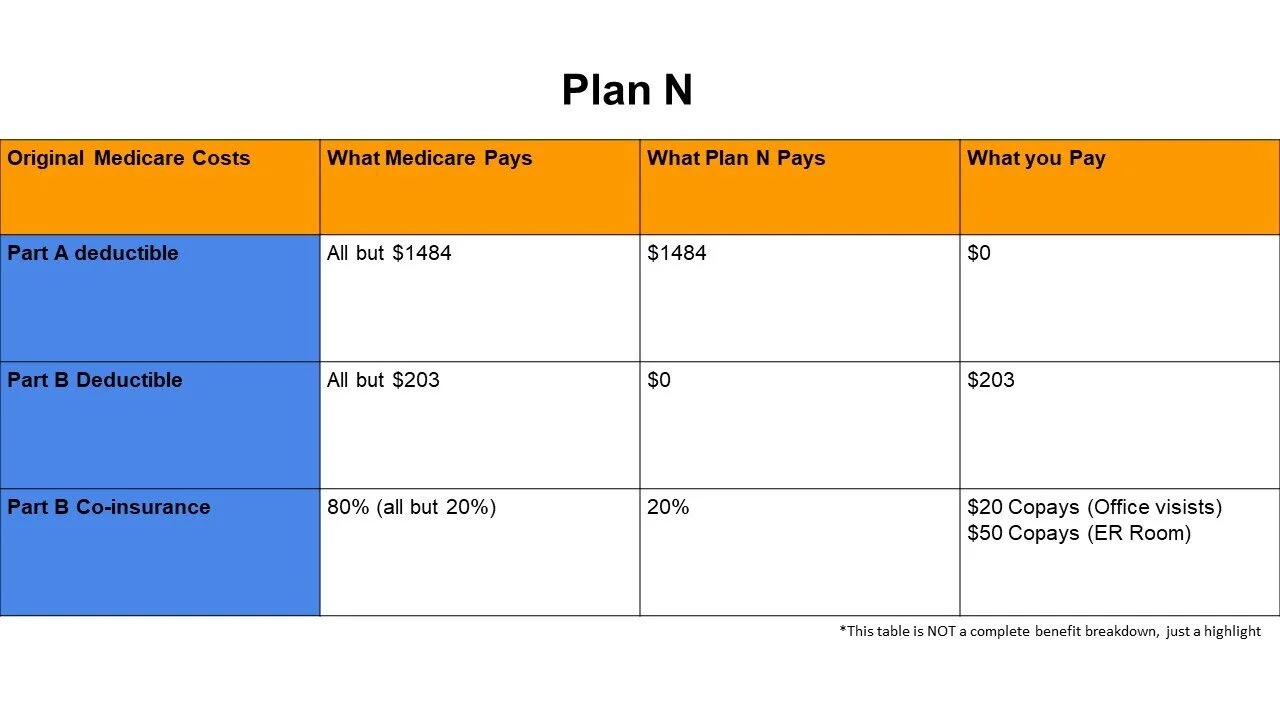

Plan N “The Economical Supplement” $ - Plan N is the third popular Supplement plan. As with Plan F and Plan G, Plan N covers 100% of your inpatient Medicare Part A costs. The outpatient coverage on Plan N is a little different. Like Plan G, you are responsible for the $203 annual Part B deductible. Once that is met you pay $20 copays for doctor office visits (primary care, specialist etc) and $50 copays for ER room visits. Plan N also doesn’t cover excess charges which are not allowed in every state.

On a monthly basis, Plan N is the cheapest supplement plan out of these 3 listed. The average price for a Plan N at age 65 is around $120/mo. This plan is a good balance between a lower monthly cost plan that still provides all the great features and benefits of a supplemental plan.

There are other Supplement plans available in addition to these options but we tend to see plans F, G and N as the most popular choices due to a good balance of monthly cost and rich benefits. If you’re approaching Medicare and want to explore these options we would be happy to help. If we missed anything or you want us to write about something else, please leave us a comment, reach out to help@doctorschoiceusa.com or call our office at 401-404-7373. As always, thanks for reading!